31 Aug Clarify Your Financial Situation with a Braided Funding Template by AGS Staff

Every grant proposal requires some type of budget. Unfortunately, some of us tend to put off this component for as long as we can. However, it should really be the starting point. When we write a proposal, it should be for the purpose of filling a gap in our budget, not just to get money for money’s sake. In a previous blog, Julie Alsup introduced the idea of braided funding. Here, let’s walk you through the nuts and bolt of implementing this useful concept.

You can think about this template similarly to a case statement, which serves as a reference for proposal narratives. The braided funding template will serve as a reference for all your proposal budgets. Hopefully, you already have an organization annual budget or profit and loss statement you can draw from. Starting there, you can take the following steps to create this very useful tool:

- Across the top of an excel spreadsheet, head each of your columns with your sources of funding (ABC Foundation, City Funding, etc.).

- In the far-right columns, include a total and then a “target total” so you can compare them in the end.

- Along the left side, title each row with those same funding sources in a revenue section, and title the rows in the expense section with some general cost categories. Examples could include salary, fringe benefits, program costs, admin, equipment, travel, consultants, or conferences. You can also add specific line items to see where restricted funding is allocated with greater detail. For instance, whose salaries?

- Next, you’ll want to set up some excel formulas so that your “total” cells are a sum of everything in its respective row and also add a row below all revenue and one below all expenses with a sum of each column respectively.

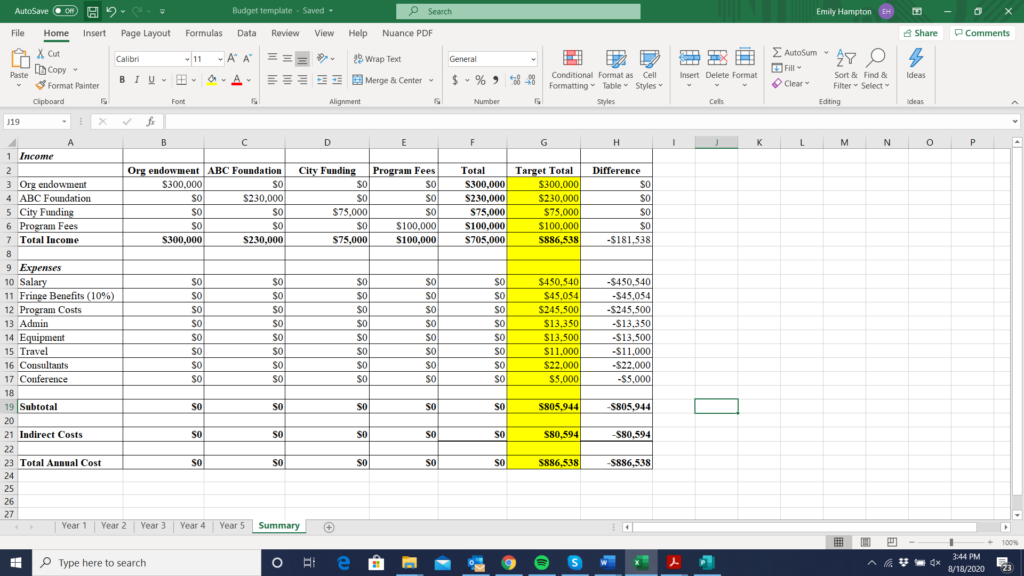

- Lastly, you will simply fill in your current financial situation. Put how much you receive or expect to receive from each funder/source in the cell that matches both its row and column and put your total category expenses in your “target total” column. This is what it should look like now:

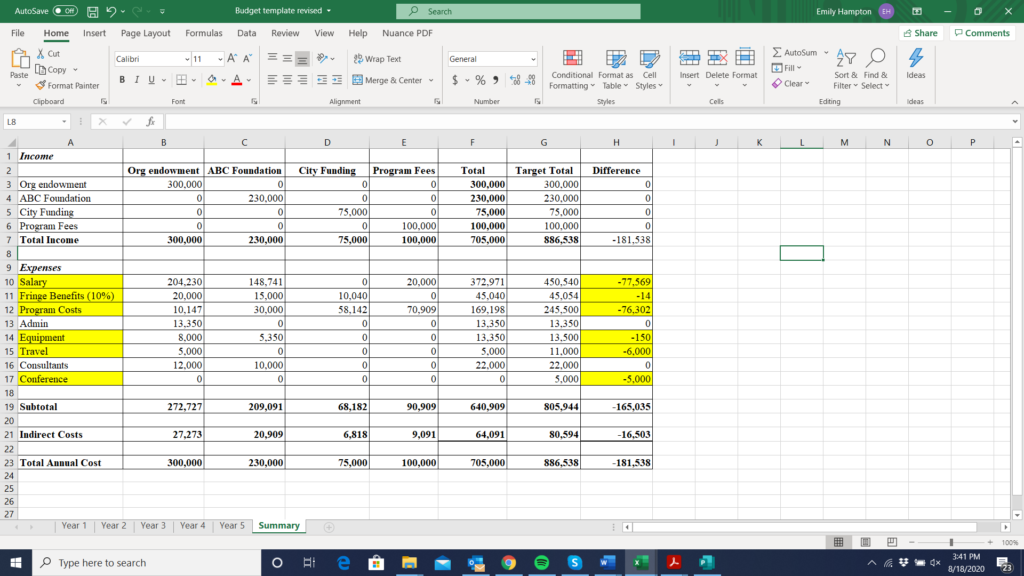

- Allocate how much funding from each source will go toward each expense – putting that amount in the appropriate expense row and funding source column (fill in the zeros in expenses accordingly). Then you’ll just want to double-check that your target totals match your actuals and see where you have funding shortfalls in the “Difference” column. In the example below, you can see that there are funding gaps in the highlighted categories in column A and you can see how much funding you still need to secure for those categories in column H.

This sounds intimidating, right? It is certainly tedious work- we know, we just created one. However, there is nothing more satisfying than having your organization’s finances clearly and accurately laid out in one document. Okay, maybe you can think of more satisfying things. But trust us, once this is complete, it will be very valuable to your organization and any grant professional consultants you may work with! Why?

What you’ll have in the end is a clear picture of which aspects of your organization are financially secure and where you have funding gaps. This means you’ll know what you should be requesting funding for in future proposals. You’ll be able to clearly explain funding gaps to your board of directors and save time and energy by targeting funders that fit that gap. Your proposals will be written more clearly as they will focus on specific areas that will benefit most from funding. Funders will be able to see where they can be most helpful. Therefore, you will be more likely to receive funding while also saving resources by not asking for things you may not really need. Everybody wins!

Competency 4.10: Identify factors that limit how budgets are written